According to Utrecht University, Dutch mortgage deeds have been recently called one of the most unintelligible documents to read in the Dutch language. Sure, it’s full of jargon and legal terms, but it is also contains too much information per sentence, sentences that are too long in any case, unnecessary auxiliary verbs and one of my pet peeves, too many passive sentences. Even campaign flyers and research articles are written more succinctly than mortgage documents, a conclusion linguists reached after analysing the written materials of 42 mortgage deeds from 21 agents.

And even after simplifying the 42 deeds, only 69 percent of respondents said they understood the newer version, as compared to 57 who understood the old versions.

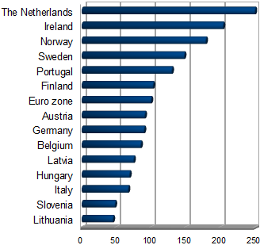

Besides barely understanding what you’re signing up for even for native Dutch speakers, many articles will tell you that the Dutch have the highest household-debt levels in the euro zone, which is all due to mortgages costing more than the value of people’s homes. Amsterdam being the place to be for many people, it is currently on a real estate bubble list, moving from ‘overvalued’ in 2015 and 2016 to ‘bubble risk’ in 2017.

(Link: nu.nl)

ABN Amro’s mortgage portfolio has decreased by 0.3 billion euro because house owners have been making extra payments using their holiday bonuses, the troubled bank writes in its

ABN Amro’s mortgage portfolio has decreased by 0.3 billion euro because house owners have been making extra payments using their holiday bonuses, the troubled bank writes in its