Two weeks ago Timothy Young, a librarian from Yale University in the USA, travelled to the Netherlands to collect 136 euro and 20 cents in interest from the water board De Stichtse Rijnlanden.

The interest was paid on a bond issued for 1,000 guilders in 1648 by the predecessor of the current board to fund the building of a groyne. At the time, the Netherlands was going through its Golden Age and the navigability of important trade routes like the main rivers was a priority (German link).

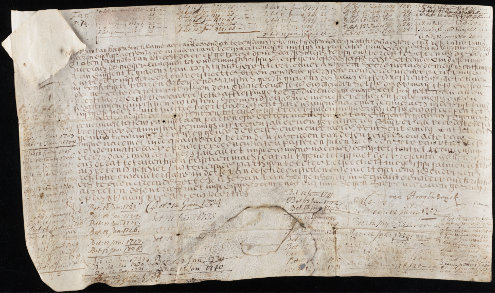

Interest on the bond must be collected at least once every generation, Yale News reports. The bond (issued by the water board of Lekdijk Bovendams) remains one of the oldest known living financial instruments in the world as long as interest is collected—the reason that Yale, which paid 24,000 euro for it in 2003 according to Bloomberg, is keen to collect those payments.

The document is a bearer bond, meaning the issuer needs to see it before paying out interest. The issuer will then write the payment date on the document. This would have provided a bit of a problem for Yale, because carting around a 367-year-old sheep skin across the airways might be detrimental to its health. Luckily, space on the bond proper already ran out in 1944 and in the same year an allonge was attached to it for keeping track of the payment dates. The water board allows the bearer to simply show the allonge.

The water board has records of five other bonds that still generate interest payments. The oldest of these was issued in 1624 for 1,200 guilders, also by the water board Lekdijk Bovendams. The same water board issued bonds for a total of 300,000 guilders in the first half of the 17th century after the 32-kilometre-long eponymous dike burst numerous times, the water board writes.

Water boards are a type of parallel local government that have been around since the Middle Ages. They take care of dikes and dams, among others, in a country of which 55% of the surface area is susceptible to flooding from either the sea or from rivers. Some of these boards belong to the oldest continuous governments in the Netherlands. The water board of Lekdijk Bovendams was founded in 1323 by the bishop of Utrecht and was later managed by the king, until 1971 when it was merged with a number of other water boards into the water board Kromme Rijn, which itself was later merged into the current water board De Stichtse Rijnlanden.

(Photo of groynes at the Bovendamse Lekdijk by E. Dronkert, some rights reserved; photo of the bond by Yale University)

Z24

Z24