It’s only getting tougher to find a house to buy in The Netherlands. There’s a lack of affordable houses, often bought up at hundreds of thousands of euro above the asking price (according to Dutch news show Nieuwsuur on 31 May 2021), more often than not by investors who will subdivided the houses into small and make tons off renting them. By the way, this practice should be heavily restricted in 2022 if all goes as planned.

Nathalie, 40, lives alone with her daughter, a dog and a bunny in 46 square metres and pays €950 in rent before utilities. She pays more than most, and less than some. However, she is unable to put money aside to buy a house and cannot get social housing because her salary is often just above the limit. Many people are in similar situations.

Since she cannot find a house, she has decided to try her hand at crowdfunding to raise €1 million from 1 million people. “If everyone sends a euro, I’ll soon have my dream house.” Of course, social media has made mince meat of her cry for help, but I’ll give her points for trying and being honest about it. As I write this, she has raised €7.530, with about a year to go for the rest.

Back in 2005, Canadian blogger Kyle MacDonald bartered his way from a single red paperclip to a house in a series of fourteen online trades over the course of a year and everybody through he was brilliant, just saying.

(Link: waarmaarraar.nl, Photo: designboom.com)

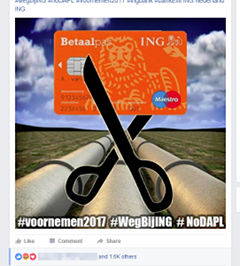

Over the past few days, stuck among the daily river of memes, one stood out because friends were making a commitment: they were going to cancel their account with Dutch consumer bank ING over the bank’s investments in the controversial

Over the past few days, stuck among the daily river of memes, one stood out because friends were making a commitment: they were going to cancel their account with Dutch consumer bank ING over the bank’s investments in the controversial