I first heard about a dog tax in a French comic book as a child. A family was playing a record on a turntable of the Skater’s Waltz by Frenchman Émile Waldteufel, sung by dogs, according to the drawings, of course. The family had earlier claimed they did not have a dog and at some point, the dog tax collector came back and gave them a fine for having a lot of dogs after hearing the record through the front door.

Like many things in the Netherlands that make little sense, municipalities often charge very different fees for things that shouldn’t be that different from one place to the next. A quick look at Noord-Brabant has Tilburg (107,86 euro) and Breda (104,55 euro) as the most expensive, followed by Veldhoven (84,18 euro), Den Bosch (83,64 euro) and Eindhoven (77,00 euro).

Municipalities that charge over 100 euro include The Hague and a few other places close to it that border the coast, Groningen way up north, Nijmegen next to Germany. Dog owners in 57 per cent of all municipalities still pay dog tax. One reason for a large amount of municipalities not to charge dog tax is that they need to have collectors and that’s expensive and not always very efficient.

Not only is dog tax apparently the oldest type of tax in the Netherlands, it’s also rarely used for cleaning up dog poop.

For anybody who cares about the situation in Noord-Brabant, feel free to sign a petition in order to get rid of dog tax.

Link: omroepbrabant.nl)

The Dutch branch of the Church of the Flying Spaghetti Monster has scored a small victory. On Tuesday the Utrecht Chamber of Commerce has allowed the church to be entered in the company register,

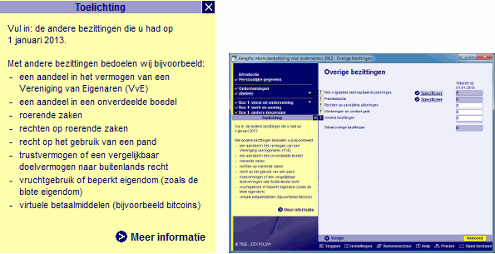

The Dutch branch of the Church of the Flying Spaghetti Monster has scored a small victory. On Tuesday the Utrecht Chamber of Commerce has allowed the church to be entered in the company register,  The Court of Justice of the European Union has ruled that Bitcoin is a currency and that trading in it is exempt of VAT.

The Court of Justice of the European Union has ruled that Bitcoin is a currency and that trading in it is exempt of VAT.  Are the Dutch goody two-shoes or do they merely possess a strong sense of civic duty? I’ll leave that for our readers to decide.

Are the Dutch goody two-shoes or do they merely possess a strong sense of civic duty? I’ll leave that for our readers to decide.

It sounds like a win-win plan for everybody: the government subsidizes the purchase of solar panels for private families who use the panels to generate clean energy and sell any left over electricity to the public utilities.

It sounds like a win-win plan for everybody: the government subsidizes the purchase of solar panels for private families who use the panels to generate clean energy and sell any left over electricity to the public utilities.  Dutch people who accept payments in the new Internet currency Bitcoin will have to pay income tax on the funds they receive. Finance Minister Jeroen Dijsselbloem confirmed this two weeks ago after parliament had asked questions about Bitcoin,

Dutch people who accept payments in the new Internet currency Bitcoin will have to pay income tax on the funds they receive. Finance Minister Jeroen Dijsselbloem confirmed this two weeks ago after parliament had asked questions about Bitcoin,  What do you do if you don’t trust the banks? You keep your money under your mattress.

What do you do if you don’t trust the banks? You keep your money under your mattress.  Why would you want to ask a court whether an Apple iPad is a phone or a general computer? Well, if computers given as a Christmas bonus are considered income and phones are not, you might have an incentive, especially if the back taxes amount to 323,687 euro.

Why would you want to ask a court whether an Apple iPad is a phone or a general computer? Well, if computers given as a Christmas bonus are considered income and phones are not, you might have an incentive, especially if the back taxes amount to 323,687 euro.