Bunq, a relatively new Dutch bank based in Amsterdam, recently had one of their clients attacked in India while trying to pay with the bank’s rainbow coloured bank card. Founder and CEO of Bunq Ali Niknam said he was shocked about this incident on social media.

The client ended up in the hospital. Comments on social media included making the card ‘less gay’, but then beating a person over a bank card, not even for money, is a violent crime. The gay rainbow flag doesn’t even use the same colours: it has six colours (missing one to make it a rainbow), while Bunq uses a few more different colours on its cards and 12 on its logo. Other companies including Apple have used and still use rainbow colours and that’s still not a reason to beat someone up, neither is being homophobic, if that was the case.

Nikham wrote a nice ‘message of love’ about the incident, something I cannot picture any other bank doing these days, so hats off to him (nope, 24oranges HQ is with another bank). Our Twitter timeline was full of folks from India denouncing this behaviour or explaining it away in shame, as it is criminal, violent behaviour. Over a piece of plastic.

(Link and photo: joop.bnnvara.nl)

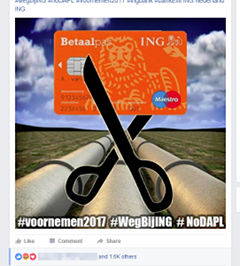

Over the past few days, stuck among the daily river of memes, one stood out because friends were making a commitment: they were going to cancel their account with Dutch consumer bank ING over the bank’s investments in the controversial

Over the past few days, stuck among the daily river of memes, one stood out because friends were making a commitment: they were going to cancel their account with Dutch consumer bank ING over the bank’s investments in the controversial  The court of The Hague has rushed to the aid of Dutch bank Rabobank when it censored the book ‘De Verpanding’ (The Pawning) last Friday.

The court of The Hague has rushed to the aid of Dutch bank Rabobank when it censored the book ‘De Verpanding’ (The Pawning) last Friday. One in three Dutch companies wants to break up with its bank, but only one in six thinks this is possible,

One in three Dutch companies wants to break up with its bank, but only one in six thinks this is possible,  Two students of the Eindhoven University of Technology have discovered that the least safe code for your bank card (PIN) is 2580.

Two students of the Eindhoven University of Technology have discovered that the least safe code for your bank card (PIN) is 2580. Financial news site

Financial news site  Last December, Paul Wiegmans from Alkmaar

Last December, Paul Wiegmans from Alkmaar

Tour company Amsterdam Excursies has decided to profit from the financial crisis by organizing themed guided tours of the financial history of Amsterdam. It’s

Tour company Amsterdam Excursies has decided to profit from the financial crisis by organizing themed guided tours of the financial history of Amsterdam. It’s