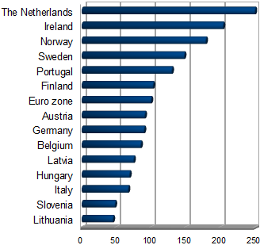

An OESO study has discovered that the Netherlands bucks the trend of the rich getting richer at the expense of those paying for the crisis.

An OESO study has discovered that the Netherlands bucks the trend of the rich getting richer at the expense of those paying for the crisis.

Good news, then? Not really. Z24 points out that the Dutch poor are also getting poorer. The group of people that live below the poverty line has increased from 6.7% in 2007 to 7.8% in 2011. In this study ‘rich’ is defined as belonging to the top 10% in disposable income and poor as the bottom 10%.

The financial news site points out that the poor have lost less income than the rich, which is an interesting mathematical factoid, but otherwise devoid of meaning in my opinion. If the poor lose 1.5% of their income it means they go without food for another five days in a year, while for the rich it means they have to wait five days longer before they can purchase their next luxury car. Not quite the same difference.

A group of people that has done relatively well for themselves during the crisis is the elderly whose income has stayed the same. The group of 18 to 25-year-olds has seen their income drop since 2007 by well over 2%, although those differences are minimal compared to those of the same age groups in other countries such as New Zealand and Israel where the elderly are getting rich at the cost of everybody else.

(Photo by Meraj Chhaya, some rights reserved)

One in three Dutch companies wants to break up with its bank, but only one in six thinks this is possible,

One in three Dutch companies wants to break up with its bank, but only one in six thinks this is possible,  A musical instrument shop in Groningen, a city some call the real rock city of the Netherlands (surely a bone of contention with the people of Eindhoven), is looking for someone, male or female, to sell guitars.

A musical instrument shop in Groningen, a city some call the real rock city of the Netherlands (surely a bone of contention with the people of Eindhoven), is looking for someone, male or female, to sell guitars.

Being in debt is a valid reason to be fired as a police officer, a court has ruled.

Being in debt is a valid reason to be fired as a police officer, a court has ruled.  Dutch car repair shops are having a tough time. Their turnover has been dropping for years,

Dutch car repair shops are having a tough time. Their turnover has been dropping for years,

The first dip of the current economic crisis was barely felt in the Netherlands. Predictions by the Bureau for Economic Policy Analysis (CPB) on how bad it was going to be have proved to be way off base. Instead of the predicted unemployment rate of 9%, unemployment stayed at 4%. Purchasing power even rose 1.8% in 2009.

The first dip of the current economic crisis was barely felt in the Netherlands. Predictions by the Bureau for Economic Policy Analysis (CPB) on how bad it was going to be have proved to be way off base. Instead of the predicted unemployment rate of 9%, unemployment stayed at 4%. Purchasing power even rose 1.8% in 2009. Bankruptcy trustees often keep on-line shops running even though the companies behind them have gone bust, and therefore cannot deliver the goods.

Bankruptcy trustees often keep on-line shops running even though the companies behind them have gone bust, and therefore cannot deliver the goods.  The number of Dutch tourists planning to spend their summer holiday in Greece is down 10% from last year. Competing countries like Spain and Turkey are up from last year, travel agent Steven van Nieuwenhuizen of D-Reizen

The number of Dutch tourists planning to spend their summer holiday in Greece is down 10% from last year. Competing countries like Spain and Turkey are up from last year, travel agent Steven van Nieuwenhuizen of D-Reizen  * The Delft students that designed the eco-friendly

* The Delft students that designed the eco-friendly