As of this holiday season people in Amsterdam will be able to give money to homeless people using their bank card and its contactless payment function. It’s an experiment that is making headlines, thought up by Amsterdam advertising agency N=5 and developed together with the ABN Amro bank.

The homeless will be wearing a special jacket with a bank card reader, allowing people to donate one euro that will be used to provide either food, a shower or a place to sleep to the homeless person in question. The accounts will be managed by the cooperating homeless shelters. The idea is to avoid seeing the money spent on alcohol and the likes, something that stops many people from giving. Once someone has donated, they will get a thank you from the homeless person on their bank account statement.

According to newspaper Het Parool, over the past years the homeless population in the Netherlands has more than doubled from 2009 to 2016, from 13,000 to 31,000 people.

(Link: www.parool.nl)

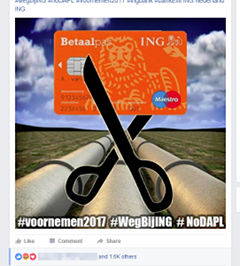

Over the past few days, stuck among the daily river of memes, one stood out because friends were making a commitment: they were going to cancel their account with Dutch consumer bank ING over the bank’s investments in the controversial

Over the past few days, stuck among the daily river of memes, one stood out because friends were making a commitment: they were going to cancel their account with Dutch consumer bank ING over the bank’s investments in the controversial

The Economist has been keeping track of the development of house prices for a while now and

The Economist has been keeping track of the development of house prices for a while now and  Two weeks ago

Two weeks ago  Rabobank has been sued by a bailiff in Utrecht, GGN, because the bank tried to have it collect outstanding mortgage debts without a court order.

Rabobank has been sued by a bailiff in Utrecht, GGN, because the bank tried to have it collect outstanding mortgage debts without a court order. Financial news site

Financial news site  Banks like ING, ABN Amro and Rabobank refuse to fit their ATMs with special anti-skimming devices that have proven successful on ticket vending machines,

Banks like ING, ABN Amro and Rabobank refuse to fit their ATMs with special anti-skimming devices that have proven successful on ticket vending machines,