About 9,000 citizens of Amsterdam received an unexpected Christmas bonus yesterday, Parool reports.

About 9,000 citizens of Amsterdam received an unexpected Christmas bonus yesterday, Parool reports.

The municipal tax office accidentally floated a comma the wrong way and instead of paying out a housing benefit of 155 euro it transferred 15,500 euro and sometimes even 30,000 euro into its clients’ bank accounts.

The annual benefit is paid on top of a similar federal subsidy that is intended to help the poorest Dutch people make ends meet. The tax office is frantically trying to retrieve the money. Parool says the office fears “most recipients will be unwilling to see a mistake in this”. In total the city has paid out 188 million euro.

“We want to deal with this in a nice way”, a spokesperson told Telegraaf. But one of the accidental recipients who called the tax office was told that if he touched the money, he’d be in trouble, AT5 reports.

Although it is funny to think of the poorest of society being ‘rich’ for a few days, I fear that for some this mistake may only mean more problems in the end.

(Photo of unrelated costume jewellery by GlitzUK, some rights reserved)

Two weeks ago

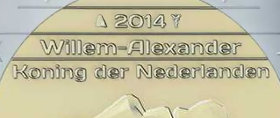

Two weeks ago  Erwin Olaf is a kick-ass photographer, but does that make him a good coin designer? The Netherlands do have to uphold a reputation in this respect.

Erwin Olaf is a kick-ass photographer, but does that make him a good coin designer? The Netherlands do have to uphold a reputation in this respect.

ABN Amro’s mortgage portfolio has decreased by 0.3 billion euro because house owners have been making extra payments using their holiday bonuses, the troubled bank writes in its

ABN Amro’s mortgage portfolio has decreased by 0.3 billion euro because house owners have been making extra payments using their holiday bonuses, the troubled bank writes in its  The three major Dutch banks—ING, ABN Amro and Rabobank—are set to introduce ‘mobile payments’ to unsuspecting consumers in two weeks,

The three major Dutch banks—ING, ABN Amro and Rabobank—are set to introduce ‘mobile payments’ to unsuspecting consumers in two weeks,

Dutch people who accept payments in the new Internet currency Bitcoin will have to pay income tax on the funds they receive. Finance Minister Jeroen Dijsselbloem confirmed this two weeks ago after parliament had asked questions about Bitcoin,

Dutch people who accept payments in the new Internet currency Bitcoin will have to pay income tax on the funds they receive. Finance Minister Jeroen Dijsselbloem confirmed this two weeks ago after parliament had asked questions about Bitcoin,  A pensioner named Gijs Koekenbier (69) has become the butt of jokes after NRC Handelsblad published the story of his financial ‘woes’.

A pensioner named Gijs Koekenbier (69) has become the butt of jokes after NRC Handelsblad published the story of his financial ‘woes’. The Kurhaus Hotel in Scheveningen near The Hague is bankrupt,

The Kurhaus Hotel in Scheveningen near The Hague is bankrupt,